You’re almost guaranteed to hear an advertisement for car insurance, but when it comes to buying or choosing the right Insurance what do you really need your first step and find the right policies to make sure you meet the state minimum insurance requirements.

If you don’t know your state requirements, visit the insurance commissioner’s website for your state or call their office they’re happy to help you get started.

But what about all the types of coverage and services that are offered.. What do you need to really be protected on the road?

An easy way to think about Auto coverage is in terms of to whom the benefits will be paid.

Some coverage pays you as the vehicle’s owner liability coverage pays others for damages you are legally responsible for as the result of an accident.

First or focus on coverages that benefit you as the policyholder. There are two types of physical damage coverage available with car insurance policies. Collision coverage and comprehensive coverage collision.

Comprehensive coverage covers the loss related to your vehicle, however collision insurance specifically covers damage caused by accidents with other vehicles and stationary objects like trees, road signs, even potholes.

It is important to remember that Collision coverage only handles repair and replacement costs up to your vehicle’s cash value.

Your vehicle’s actual cash value is not how much you paid for it; the actual cash value is the vehicle’s current value considering factors like it’s age, mileage, and condition.

With this coverage will be asked to select a deductible.

The deductible is the amount you’ll be responsible for paying for each month you are covered.

The second type of damage coverage for bigger vehicles is comprehensive; this covers damages your vehicle and cruise from non-accident events like weather and vandalism.

Two other types of personal coverage you should consider are rental reimbursement and gap insurance.

Rental reimbursement pays for a rental vehicle if your car is not drivable as the result of a covered or insured loss is optional and not required as part of your insurance policy.

However it can be beneficial if your car must be in the repair shop for several days and if you do not have access to another vehicle.

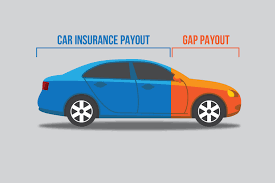

If your vehicle is financed you may also want to consider gap insurance; this is the difference between the actual cash value of a vehicle and the balance still owed to a lienholder or in a car loan.

These programs help prevent you from being upside down on your loan and the bank more than the actual cash value.

In the result of a total loss situation however before you purchase this coverage from your insurance agent be sure to check your loan or financing agreement, many times gap insurance is a part of the loan agreement when you purchase a vehicle however double check to make sure you don’t already have gap insurance.